The e-filing deadline for 2024 is rapidly approaching in December.

It’s essential to note that this window of opportunity closes annually, and failure to comply will result in late fees, penalties, and potential interest charges come late January.

It’s crucial to organize your financial records and submit your outstanding tax returns promptly.

To schedule a book evaluation or catch up on your books, please contact me today.

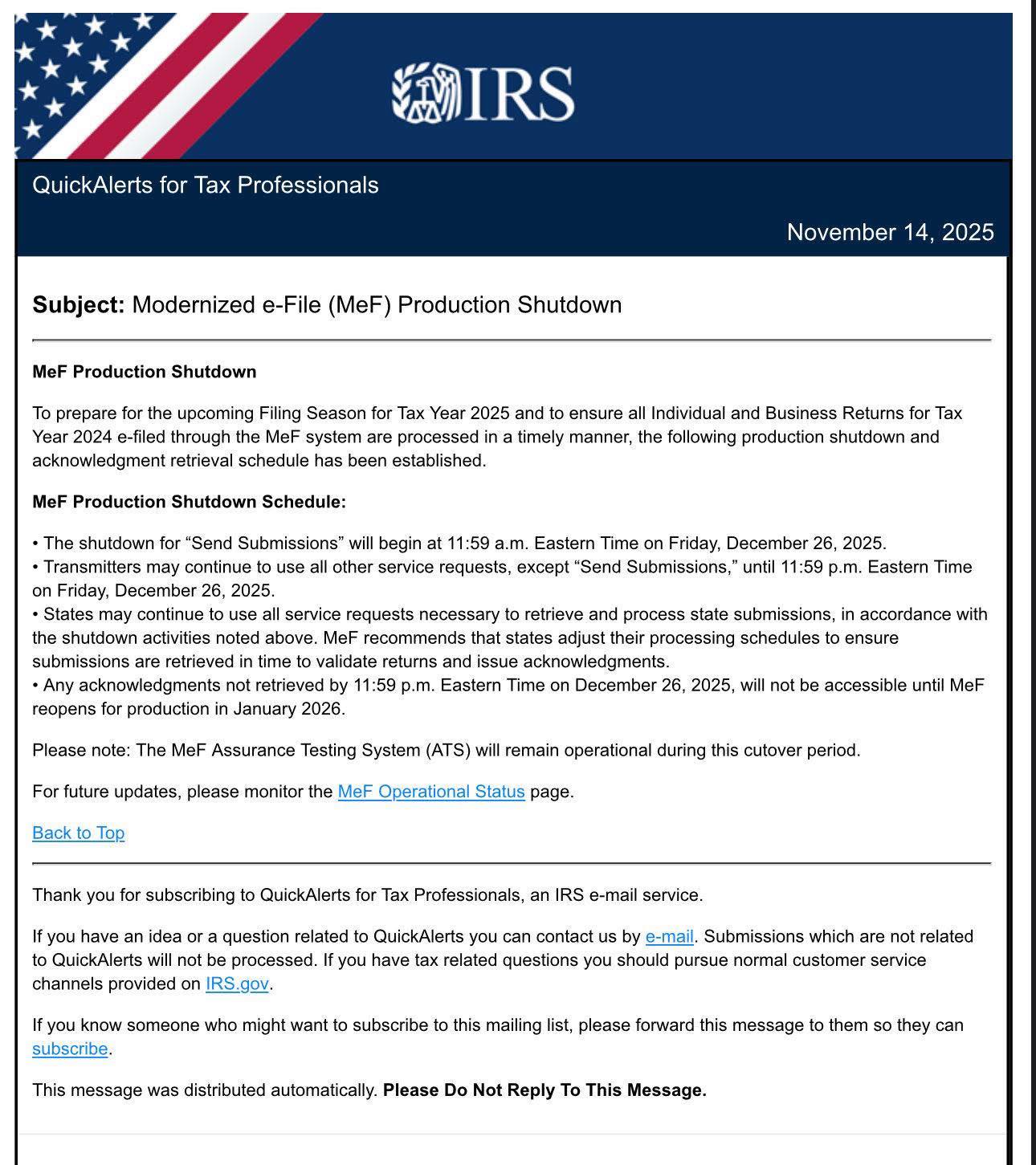

For more information, refer to the IRS Alert here.